“I don’t want to make more money because I’ll end up in a higher tax bracket and lose more to taxes!”

This is a common misconception about taxes, so let’s clear it up.

Our tax system is progressive, which means you only pay the higher tax rate on the portion of your income that falls into that bracket—not all of it.

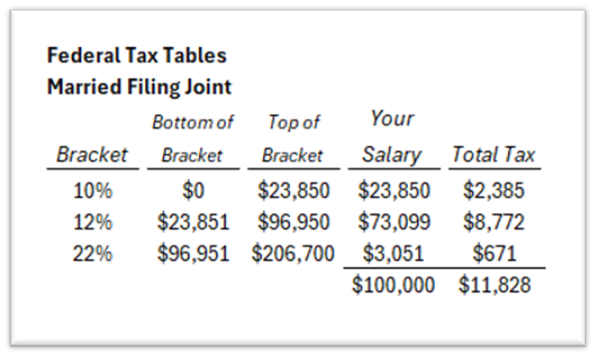

Example:

Let’s say you go from making $95K to $100K. Assuming you are married filing joint, this would take you out of the 12% bracket and into the 22% bracket. The good news is:

➡️ You’re NOT paying 22% on all $100K.

➡️ You’re ONLY paying 22% on about $3K (the difference between the top of the 12% bracket & $100K). The rest of your income is still taxed at the lower rates. If you look at the illustration below, you can see how the “effective tax rate” (total tax / salary) is ~12%, not 22%. Note: for simplicity & illustrative purposes, I am choosing to ignore the impact of deductions and credits on this calculation.

So no, making more money doesn’t mean you’ll be taking home disproportionately less, and if offered a raise you should definitely take it!

I believe that making more money is always a good thing, and with the right tax strategies, you can keep even more of it!