If You Want to Eliminate Surprise Tax Bills – It’s All About Planning

Taxes are never fun—but they’re even worse when you the “plan” is simply to hope for the best. Most surprise tax bills aren’t caused by

Taxes are never fun—but they’re even worse when you the “plan” is simply to hope for the best. Most surprise tax bills aren’t caused by

I had a blast recently joining Candy Messer on the “Biz Help for You” podcast! On it we discussed: I really enjoyed my time with

When I talk about offering both tax prep and tax strategy, one of the first questions I hear is, “What’s the difference?” It’s a fair

The Health Savings Account (HSA) is one of the most powerful tools in the tax code. Is the only account where the IRS let’s you

Many small businesses want to help employees with healthcare costs—but traditional group health insurance can be expensive. The good news? There are ways to offer

I was honored recently to appear on the Super Clinic Podcast to talk with host Jennifer Gligoric! We discussed: I had a great time &

A bad business year can feel discouraging—but from a tax perspective, it doesn’t have to be a waste. If your business expenses exceed your income,

While 2025 is winding down and there are only a few days left in December, there are still a number of things you can do

I was honored to be a guest with Dominic DeLaquil on the “Financial Independence for Kids” podcast recently! We talked about: Timestamps: Dominic was a

If you’re self-employed and driving for business, the mileage deduction is one of the easiest ways to cut your tax bill. For 2025, the IRS

I was honored to recently be a guest on Stuart Webb‘s “It’s Not Rocket Science – Five Questions Over Coffee” podcast where we talked about:

What Is An Accountable Plan?An accountable plan is your company’s written reimbursement policy that pays employees back for bona-fide business expenses without treating those reimbursements

I am excited to announce that after two years proudly carrying the Certified Tax Coach (CTC) designation, I have earned the next level: Certified Tax

I am honored I got to speak at the Southern Lancaster Chamber of Commerce’s 2025 Business Expo! I led a breakout session on budgeting &

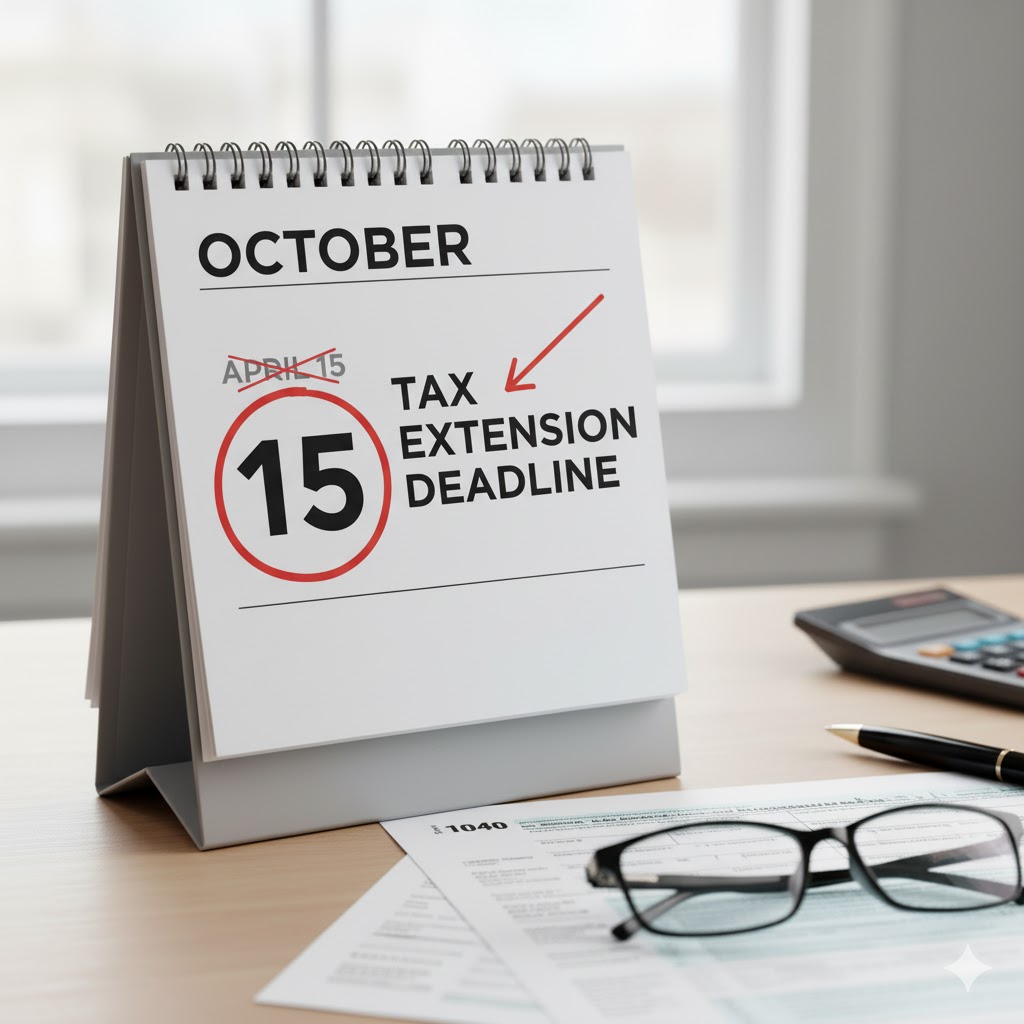

There’s this idea floating around that if you file an extension, its a “bad thing” or that the IRS is going to come knocking. Not

Every year a common question is: “Why do I need to make estimated payments?” Typically followed by, “How much do I need to pay in?”

Whether you call it the “14-day rental rule,” “Section 280A(g) exclusion” or the “Augusta Rule,” the IRS actually allows taxpayers to rent out a personal