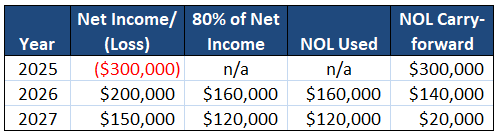

An NOL (Net Operating Loss) is just a tax term for when your business losses money in a year. While losses are never fun, the silver lining is that the IRS allows you to carry that loss forward indefinitely and use it to offset up to 80 % of the current year’s income. In other words, lower tax bills in your next profitable years and better cash flow when you need it most.

Why you might have an NOL:

• Large first year startup costs

• Cost seg or bonus depreciation creating larger deductions

• A down year in a cyclical industry

How the carry forward works:

Let’s say your business lost ($300K) this year, then had a profit of $200K next year, and then had a profit of $150K in 2027. The beauty of NOL’s is that you don’t loose that ($300K), you get to carry it forward!

️Planning Tip: Switching tax preparers? Make sure your new preparer has copies of your last two returns and are aware of any losses you had. Overlooked carry forwards are one of the simplest ways new clients overpay.

Losses sting, but if you carry them forward they’re a built in rebate on future profits.