Overview:

Another great way to defer, and partially eliminate, capital gains is Qualified Opportunity Zones (QOZ). These are designed to encourage investment in particular economically distressed areas by offering tax incentives. QOZ’s are an investment vehicle, so your original investment will grow & appreciate over time. However, the unique benefit of QOZ’s is that if you hold your investment long enough, you can eliminate tax on the growth entirely!

PRO’S:

- Defer capital gains on the original sale:

- Sales prior to 12/31/26 will be recognized on 2026 tax return (filed in spring 2027)

- Sales after 12/31/26 will be recognized on a rolling basis, 5 years from the original sale

- Sales after 12/31/26 will receive a10% step-up in basis on the deferred gain if held for 5 years (i.e. only pay tax on 90% of the gain!)

- 100% tax-free on appreciation of your sale if held for 10+ years

- Works with many asset types — not just real estate

CON’S:

- Often limited or no cash flow from the investment in early years

- Must work with a specialized fund — compliance costs apply

- Geographic restrictions (must be in designated zones)

Example:

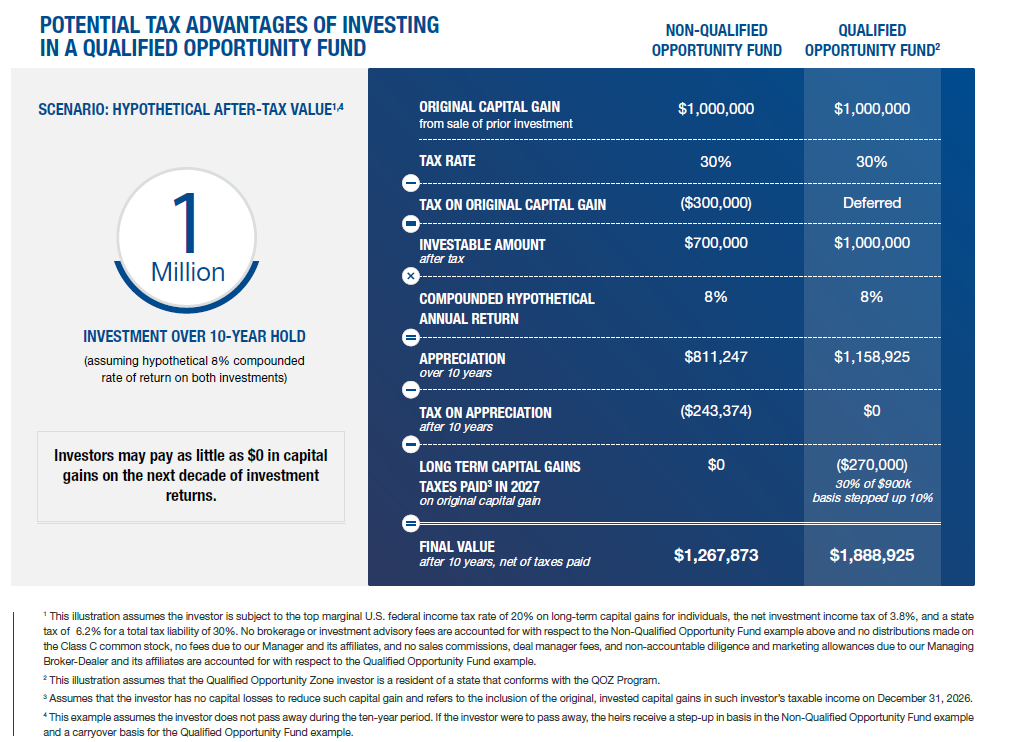

I really like this example from Cantor Fitzgerald as it shows how someone who takes a $1MM capital gain after 12/31/26 & rolls it into a QOZ would eventually come out $621K ahead of someone who rolls that $1MM into another type of investment!

Note: this illustration was prepared prior to the One Big Beautiful Bill Act (OBBBA), so eagle-eyed readers will note that second to last row references taxes paid in 2027. As previously mentioned, due to OBBBA, investments made after 12/31/26 will pay taxes 5 years afterwards. The date has changed, but the math is the same.

Important Consideration:

QOZ’s are not a simple tax strategy. The goal of this post is not an exhaustive how-to, but to show you that you do have options for lowering this year’s tax bill. Always involve your CPA, CFP, and attorney when determining if a QOZ makes sense for your situation.

And if you aren’t currently working with a CPA and would like to learn more, please let me know; I’d be happy to help you determine if a QOZ would benefit you!