When most people think of an IRS audit they often feel like a bit like the anonymous subject of Edvard Munch’s The Scream. However, statistically, your chances of getting audited by the IRS are actually pretty low.

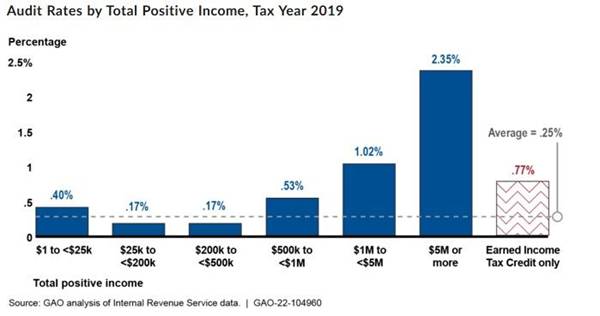

According to CBS News, only 0.2% of people were audited in 2020; or about 1 in 500. This is down from a report from the Government Accountability Office (GAO) on 2019 audits, where the average was 0.25%.

As your income goes up, so does your chances of being audited. The GAO notes that once you hit $1MM your chances jump up to 1%, and over $5MM your chances are 2.3%.

While its not possible to completely reduce your risk of being audited to 0%, there are some steps you can take. First, make sure you’re working with a tax pro who is not just bringing you tax strategies, but is advising you on the risks of each strategy. There are some strategies (e.g. Captive Insurance policies) that have a higher risk of audit then others. Depending on what your risk tolerance is and your goals, that is not necessarily a bad thing, just something to be prepared for. Secondly, make sure you’re working with a tax pro who is well organized & has good record retention policy. That way if the IRS does come knocking, you can have confidence that you and your tax pro are well-organized and prepared to substantiate every deduction you’ve taken. It is also important to

At the end of the day, an audit is far less frightening when you have a trusted advisor by your side, helping you balance smart tax strategies with peace of mind.